Is your credit decision process as accurate and efficient as it should be? Financial institutions cannot afford delays or inaccuracies in assessing borrower health in the compliance-driven lending environment. One critical but often under-optimized component of this process is spreading finance, structuring, and analyzing financial data to inform credit risk decisions.

This blog explores how spreading finance supports modern credit decision frameworks. We explore its goals, the drawbacks of manual procedures, the advantages of automation, and the ways in which financial professionals can optimize their workflows to make more consistent and informed choices.

Why Spreading Finance Is Foundational to Risk Assessment

Credit decision frameworks depend on clean, structured data. The best models or experienced analysts cannot deliver reliable outcomes without accurate inputs. That is where spreading finance becomes foundational. It provides the formatted data to calculate liquidity ratios, debt coverage, profitability margins, and other key performance indicators.

With properly spread data, credit analysts can quickly assess trends over time, compare entities against peers, and identify red flags. This allows lenders to allocate capital wisely, manage exposure, and protect asset quality.

The Operational Burden of Manual Spreading

Traditionally, spreading finance has been a manual process. Analysts extract figures from PDFs or scanned statements, enter them into spreadsheets, and manually calculate ratios. Each document must be interpreted, validated, and reconciled—a process that consumes hours and introduces potential for error.

As lending volumes grow, this approach becomes unsustainable. Manual spreading delays decisions, adds cost, and exposes institutions to data inconsistency or omission risk. In an industry where accuracy and speed matter, reliance on outdated methods can be costly.

How Automation Is Reshaping Spreading Finance

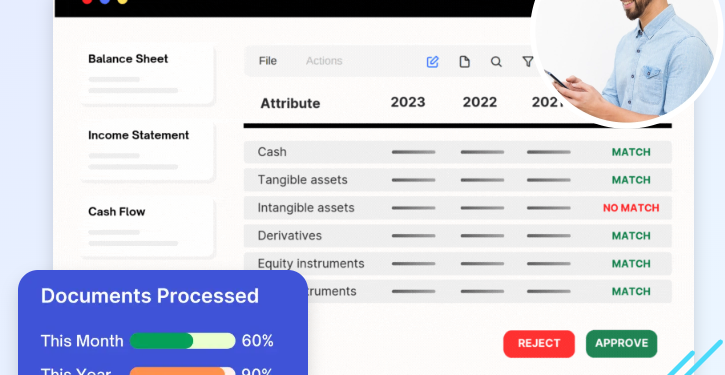

Modern document intelligence and AI technologies transform finance from a manual task into an automated, scalable function. Intelligent systems can extract financial data from diverse statement formats, normalize entries, reconcile values across documents, and generate ratios automatically.

This reduces turnaround time from hours to minutes. More importantly, automation ensures consistency across all borrowers and lending scenarios. It eliminates human bias and variability, delivering cleaner data to downstream credit models or human reviewers.

Enhancing Credit Decision Frameworks With Automation

In the broader credit framework, spreading finance automation supports faster origination, streamlined underwriting, and more effective portfolio monitoring. By eliminating data entry friction, teams can focus on strategy, risk evaluation, and customer service.

Automation also enables real-time data validation and flagging of anomalies. If a balance sheet total doesn’t match the accompanying cash flow, the system identifies the discrepancy instantly. This promotes early intervention and more informed decision-making.

Why Spreading Finance Supports Regulatory Compliance

Beyond operational efficiency, spreading finance is crucial in maintaining regulatory compliance. Financial institutions must document their decision rationale, demonstrate data integrity, and support their conclusions with consistent analysis.

Automated spreading provides audit trails, version control, and reconciliation logs—features essential for demonstrating due diligence during audits or reviews. Regulators increasingly expect transparency, and firms that automate spreading processes are better positioned to deliver it.

Empowering Analysts With Clean, Structured Data

Analysts and credit officers benefit directly from well-executed spreading finance practices. With access to structured, validated data, they can focus on deeper analysis, such as comparing projections to historical performance or evaluating qualitative factors.

This reduces time spent gathering and formatting data, increasing capacity to handle more reviews without sacrificing quality. Standardized data also improves collaboration across departments, as it allows for unified reporting and cross-functional insights.

Building Scalable Lending Operations

For organizations seeking to scale, spreading finance must be more than just accurate it must be automated, consistent, and integrated with other systems. Whether you are evaluating dozens or thousands of borrowers, a scalable process ensures that each credit file is built on reliable, high-quality data.

Integration with loan origination platforms, CRM systems, and risk models allows for a more cohesive workflow. Financial institutions adopting this approach can process more applications with fewer delays, improving operational efficiency and borrower experience.

What to Look for in a Spreading Solution

When evaluating tools to enhance spreading finance, key features to prioritize include:

- High data extraction accuracy from diverse document formats

- Automated reconciliation across financial statements

- Multi-language and multi-format support

- Ratio calculation and financial intelligence outputs

- Integration with credit, risk, and compliance platforms

- User-friendly dashboards and audit traceability

These capabilities help transform data into decisions while reducing manual burden.

Conclusion

In a lending landscape shaped by digital transformation and regulatory scrutiny, the question is not whether to modernize but how soon. Organizations recognizing the central role of spreading finance in credit decision frameworks will gain operational agility, risk resilience, and

a sharper competitive edge.

By automating financial spreadsheets, financial institutions can achieve greater accuracy, faster processing, and more consistent outcomes. The benefits are measurable and immediate, whether for credit assessment, risk modeling, or audit readiness.

To compete effectively in the data-driven lending environment, now is the time to elevate spreading finance from a back-office task to a strategic capability.